Do you know that every country has a dynamic interest rate that influences its economy and in particular, MSMEs? It refers to the amount a lender charges an individual who borrows money from them, and it is expressed as a percentage of the principal.

Well, we are referring to the interest rate at which commercial banks can borrow funds from a nation’s central bank. It is one of the primary instruments of financial policy, and it can be used to either combat inflation or stimulate economic growth.

The value of a country’s currency in the international market is impacted by the interest rates in that country.

What is the current interest rate in different countries?

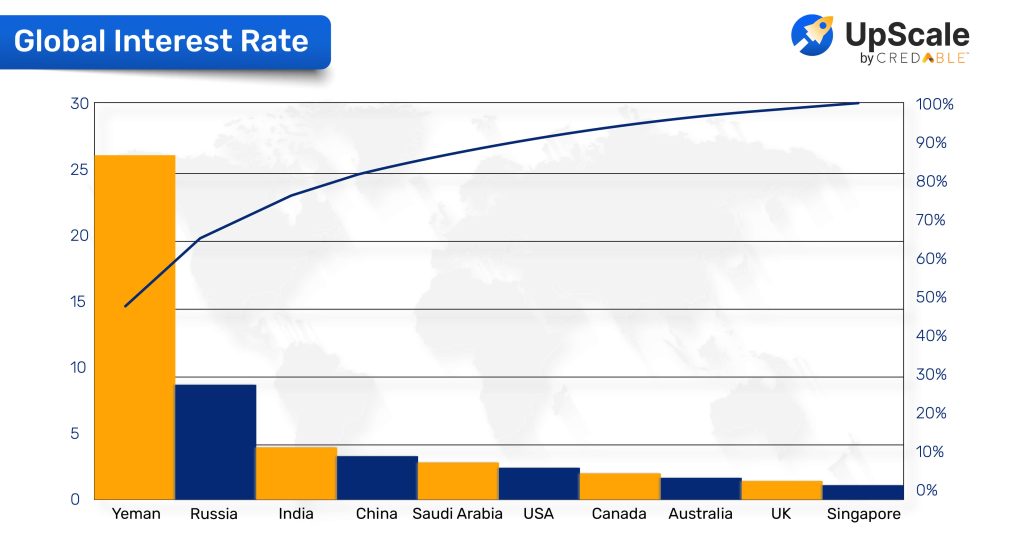

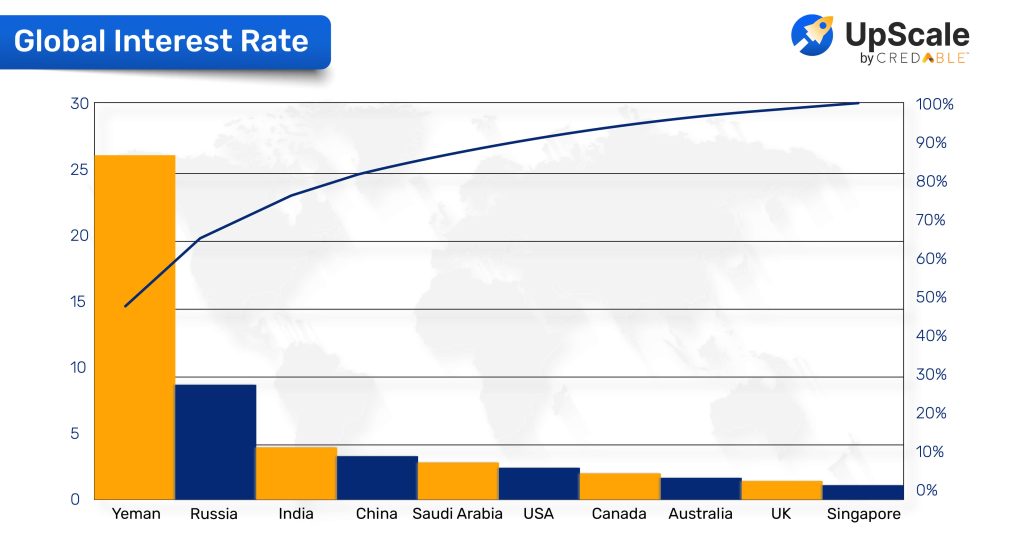

While some G20 countries, such as Singapore, the United Kingdom, Australia, Canada, the United States, and Saudi Arabia, had interest rates ranging from 0.64 to 1.75 in June, China, India, and Russia had rates ranging from 3.7 to 9.5. Furthermore, some Asian countries, like Yemen, had an interest rate as high as 27, while Japan and Switzerland reported negative interest rates—between 0.1 and 0.25, respectively—in June. A detailed chart is shown below:

How does the interest rate impact MSMEs?

Globally, MSMEs account for 90% of firms, 60% to 70% of employment, and 50% of the gross domestic product. As the backbone of societies all over the world, they help local and national economies and keep people working, especially the working poor, young people, women, and other vulnerable groups. MSMEs face a direct impact when interest rates are raised. We know that increasing interest rates is one way to deal with inflation. When interest rates are high, people are less likely to take on more debt, and consumer demand goes down.On the contrary, when interest rates are low, MSMEs tend to borrow additional funds, ideally at a fixed rate of interest, and this will lead to an increase in the capital gearing of the company. Since the interest rate is low, they borrow cash for a longer period of time. Not just this, when interest rates are low, these MSMEs may want to pay back loans that accrue high-interest rates if it is within their capacity and take new loans.If rising interest rates are used to stop ongoing inflation, then long periods of high inflation will cause large corporate buyers’ profit margins to shrink, which will cause them to pay small and medium-sized business (MSME) suppliers later than they should.

What is the impact of high-interest rates on Indian MSMEs?

Due to the increased interest rate, India’s MSMEs sector will be adversely affected. Rising interest rates will have a significant impact on the prices of consumer durables, two-wheelers, cars, and commercial vehicles (of which 95% are sold through financing routes). Small and medium-sized businesses in India rely heavily on loans from banks and other financial institutions, and they also receive government aid through the Emergency Credit Line Guarantee Scheme (ECLGS). Increasing interest costs will cut into their profits.Further, raw material shortages or price increases are an additional burden for India’s micro, small, and medium-sized enterprises. Over the long haul, this will stifle the expansion of MSMEs.